Leon Neal/Getty Images News

Leon Neal/Getty Images News

Meta Platforms, Inc. (FB) reported an underwhelming quarter that shook the foundations of advertising technology (ad tech) investors. Meta’s disappointing FY22 guidance came after the US digital ad leader Alphabet (GOOGL) (GOOG) reported robust earnings and solid guidance.

Moreover, Meta telegraphed continued headwinds over its ad tech throughout 2022 due to Apple’s (AAPL) IDFA changes. Furthermore, it has been “compelled” to ramp its format change to short-video through Reels in its bid to catch up with the leader ByteDance’s TikTok (BDNCE). In addition, it also expects lower monetization rates over Reels due to fewer impressions as Meta continues its transition journey. If that’s not all, the company also highlighted that it continues to see supply chain headwinds and costs inflation persist. Notably, it expects such headwinds to persist throughout 2022, as advertisers adjust their budgets accordingly.

Hence, we were not surprised that FB stock ended up getting pummeled in post-market trading, declining almost 23% in the process.

We think the reaction is justified. The headwinds consist of both cyclical and structural impacts. It was trading at about 25% below our implied value fair before the release. So, we believe the market is right to adjust its expectations on FB stock’s valuation given these headwinds. Despite that, we think that FB stock buy point remains attractive. But, investors need to consider a multi-year approach with CEO Mark Zuckerberg & Team’s execution now. Hence, if you are looking for a shorter-term opportunity, FB stock may not be appropriate for you.

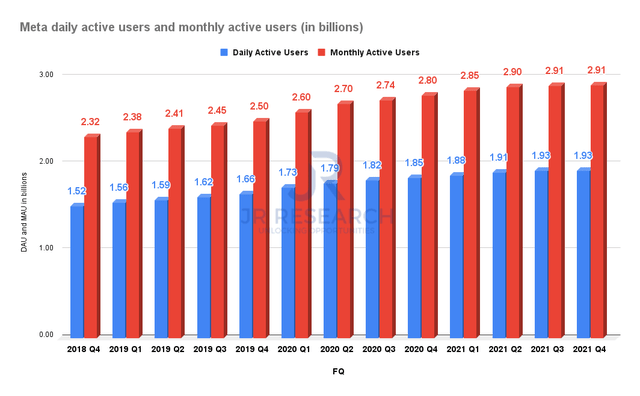

Meta DAU and MAU (Company filings)

Meta DAU and MAU (Company filings)

Meta reported daily active users (DAU) of 1.93B and monthly active users (MAU) of 2.91B. Therefore, the ratio of DAU/MAU remains resilient at about 66%. Moreover, the deceleration in QoQ growth has already been noted in previous quarters. Thus, while the sequential growth flattened in FQ4, we don’t think the market expects huge upside surprises, given that FB already has 2.91B MAUs.

We also highlighted in a previous article that Instagram will be the critical focus of Meta’s growth moving forward. But, Meta provided guidance commentary that presented clear headwinds in its bid to transition Instagram’s focus to short-format video quickly. CEO Mark Zuckerberg emphasized (edited):

What are the similarities and differences to what we’ve done in the past? The big similarity is that this is certainly not the first time that we’ve gone through a major format evolution. The transition to Reels is still in the early innings, and our ad system and business are not as tuned for the new format. So as the engagement to the new thing starts to replace some of the engagement in the old thing, it creates a near-term headwind for revenue. At this point now, it is not that big of a concern for us. Although it makes some of the stuff not as clear in the near term, but over the long term, we’re pretty optimistic about that. And with Reels, I would say that the teams are executing quite well, and the product is growing very, very quickly. (Meta’s FQ4’21 earnings call)

Therefore, it’s clear that Zuckerberg has telegraphed meaningful near-term headwinds to Instagram’s monetization capability. Nonetheless, he also clarified that it should not impact its long-term potential. Still, Meta’s move to short-format confirms that TikTok is the leader in the space now, which Meta also noted in the call.

What perturbed investors further was Zuckerberg’s acknowledgment that TikTok’s rapid adoption could pose structural headwinds in the growth of Reels. He added (edited): “The thing that is somewhat unique here is that TikTok is so big as a competitor already and also continues to grow at quite a fast rate off of a very large base. Hence, it takes us longer to kind of get to where we want on this.”

Moreover, our checks on TikTok demonstrate that it continued its rapid growth in 2021, even though it decelerated from 2020. But, keen investors should recall that TikTok was “the world’s most visited site on the internet in 2021.” Furthermore, eMarketer’s estimates also suggest that TikTok is on track to gain even more traction among marketers through 2025, surpassing YouTube, and expected to close in on Instagram’s share. Furthermore, recent Sensor Tower figures demonstrated that TikTok has continued its rapid ascendency over consumer spending. Sensor Tower indicated (edited): “Users spent approximately $2.3B last year in the mobile app, which includes the iOS version of its Chinese localization Douyin. This figure represents 77% YoY growth from $1.3B in 2020.”

Furthermore, Sensor Tower also highlighted that TikTok’s revenue reached a record high in Q4’CY21, posting $824.4M compared to $382.4M in the previous year. Furthermore, its US revenue share increased from 8% in Q4’CY20 to 13% in Q4’CY21. Notably, it represented a 3.7x increase, from just $29.6M in Q4’CY20 to $110M in Q4’CY21. Hence, while China remains ByteDance’s most important market, it’s gaining significant momentum in the US. Little wonder that has caused a considerable amount of concern at Meta Platforms.

Meta communicated clearly in the call that it sees Apple’s IDFA changes as structural. Moreover, the adjustments to navigate these changes are likely going to be a multi-year journey. Therefore, it’s a clear message to investors that the headwinds on its transition to Apple’s new AppTrackingTransparency (ATT) framework will persist in FY22.

We believe this was where the Street and the market got it all wrong, including us. Perhaps, we weren’t clear about how these privacy changes could impinge on Meta’s FY22 outlook, as we were confident that management would find a way out of trouble.

But, we thank Meta for getting its guidance clear to investors. Therefore, the warning to ad tech investors out there should be unequivocal. Apple’s IDFA changes will significantly impact the industry’s ability to target and attribute for their direct response ads. Thus, focusing on publishers’ first-party data and the ability to unlock it is even more crucial now for advertisers. But, the mood over at Apple and Alphabet in their recent earnings call couldn’t have been more contrasting. Both companies reported robust results that didn’t imply the kind of structural headwinds that Meta has telegraphed. Notably, Meta CFO David Wehner articulated (edited):

The impact of iOS overall as a headwind on our business in 2022 is on the order of $10 billion, so it’s a pretty significant headwind. E-commerce was an area where we saw a meaningful slowdown in growth in Q4. But, Google called out seeing strength in that very same vertical. And if you look at it, we believe those restrictions from Apple are designed in a way that carves out browsers from the tracking prompts Apple requires for apps. And so what that means is that search ads could have access to far more third-party data for measurement and optimization purposes than app-based ad platforms like ours. And as a result, we believe Google Search ad business could have benefited relative to us. It takes a different set of restrictions from Apple. And given that Apple continues to take billions of dollars a year from Google Search ads, the incentive clearly exists for this policy discrepancy to continue. (Meta’s earnings)

It is interesting for Meta to call out Apple and Alphabet and highlight their relationship. It seems to renew a call to regulate that relationship over antitrust concerns. Furthermore, Microsoft also weighed in Apple’s battle with Epic Games recently, calling out the Cupertino company as having “extraordinary gatekeeper power.” Microsoft also added that “if the original ruling is upheld, the result could be that it would “insulate Apple from meritorious antitrust scrutiny and embolden further harmful conduct. The company further concludes that this would mean innovation will suffer.”

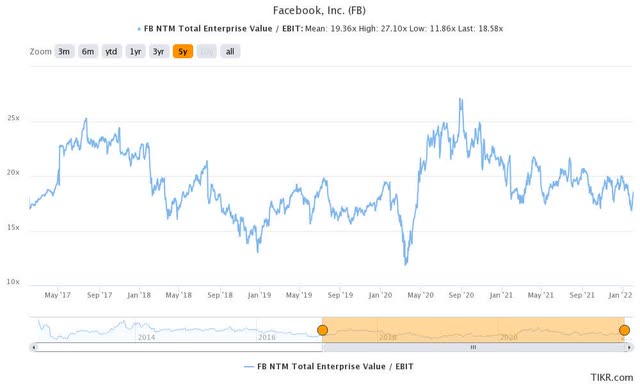

Meta stock EV/NTM EBITDA 5Y mean (TIKR)

Meta stock EV/NTM EBITDA 5Y mean (TIKR)

Before the revelations by management in yesterday’s earnings call, our implied fair value (FV) estimates point to about a 25% upside to our implied FV estimates. Moreover, Meta stock has also traded at around its NTM EBITDA 5Y mean.

Therefore, we think the market has gotten it right. These are structural headwinds that will take several years to resolve while also concurrently investing in its metaverse ambitions. The 23% hit in post-market to its stock price is justified in our opinion. Nevertheless, that also means that FB stock has been de-rated sufficiently to reiterate our Buy call.

However, we wish to emphasize that FB stock could continue to trade sideways until management shows progress in navigating these headwinds. Therefore, you should only consider FB stock if you have at least a five-year horizon.

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

24/7 access to our model portfolios

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

Access to all our top stocks and earnings ideas

Access to all our charts with specific entry points

Real-time chatroom support

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

I’m Jere Ong, the principal analyst and founder of JR Research and Ultimate Growth Investing Marketplace service.

Ultimate Growth Investing is curated to help investors achieve 5x to 10x returns over the next five years.

As a growth-oriented investor myself, I am aware of the challenges investors face in their quest to find the right growth stocks. There are so many high-potential companies in the market. As these are emerging leaders, the due diligence required is even more crucial. All growth investors want multi-bagger returns. Unfortunately, most could hardly find the time to do the necessary work.

Therefore, our service is here to help these investors. We are full-time investors and traders. We work day-in, day-out to find the best opportunities for ourselves. Now, we are extending those opportunities to these investors through the service.

If you also prefer someone to do all the hard work for you, I invite you to try out our service.

Subscribe right now because you get to try out the service for 14 days FREE. Seeking Alpha’s unconditional guarantee also protects your free trial.

Your billing only starts after the free trial. So there’s absolutely no risk at all for you to subscribe. Upon subscription, you will have access to all of our investing resources. You will also have access to our Growth Portfolio.

Come and join our community of investors as we navigate the ups and down of the market together. All our best ideas are shared only with our community in the service. Hence, you will not be able to find them on the free site.

If you have any questions, feel free to send me a direct message. I’m here to help.

I look forward to connecting with you in Ultimate Growth Investing soon!

More About Me:

I was already a full-time investor and trader before I joined Seeking Alpha as a contributor. I enjoy sharing my experience, knowledge, and mistakes with fellow investors who don’t have time to look at the market. It is not a part-time job that I do on the side. I depend on what I do for a living. I take these responsibilities very seriously.

I was previously an Executive Director with a global financial services corporation. I graduated with an Economics Degree from National University of Singapore [NUS]. NUS is Asia’s #1 university according to Quacquarelli Symonds [QS] annual higher education ranking. It also held the #11 position in QS World University Rankings 2022.

I’m also a Commissioned Officer (Reservist) with the Singapore Armed Forces. I’m the Battalion Second-in-command of an Armored Regiment. I currently hold the rank of Major.

I love spending time researching high-quality growth companies. That also includes investing time analyzing their price action. In addition, it has allowed me to develop a clear understanding of how institutional investors play their game.

Our best research ideas in the service are highly actionable. We own our best ideas and have skin in the game. Our ideas are not just designed to be a good read. Therefore you wouldn’t get abstract theories or concepts from us. You will only get timely and actionable ideas. These are also high probability and workable set-ups with lower-risk entry points.

My LinkedIn: https://www.linkedin.com/in/jjere/

Disclosure: I/we have a beneficial long position in the shares of AAPL, GOOGL, FB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.